Although you won't have employees, passive business ideas can be hard work. Freelancers will still be working for clients and need to choose how they organize their work days. And they can still get reprimanded for making mistakes. These are the top four passive business ideas. Read on to discover how you can start your own passive business today. You'll soon be on your way towards financial freedom after reading these tips.

Dropshipping

Dropshipping can be a great way to earn passive income that is low-risk and hands off. Although it might not sound like a very lucrative way to earn passive income, dropshipping can be a great option for people who don't want to have to handle product inventory and shipping. Although the process of starting a dropshipping company is straightforward, it will require some effort.

In general, passive income can be generated by Dropshipping and e-commerce. You will not need to make a huge initial investment or invest much time. While dropshipping may not involve a huge amount of work, it does require some dedication and skill. Unlike get-rich-quick schemes, this business does not require much capital. Moreover, there is no guarantee that you'll make millions overnight.

Information products

Many people make a living selling information products on the Internet. There are so many people searching for answers to specific questions. Searching forums and Facebook groups can help you find answers to common questions. Make sure your information is unique and easy to understand and put to use. You can then start marketing to this list and making money. Passive business ideas are worth exploring as long your product is of value to your customers. How can you make it sellable?

It is easy and inexpensive to create and sell information products. There is no manufacturing or shipping required. It takes very little time to produce and distribute your information product. You can charge a price depending on its niche and quality. You can even sell it for free if you have an idea of what people are looking for. However, it is possible that you will need to charge sales taxes on the product.

Investing in rental properties

Although renting out properties can provide passive income, this type of business requires more effort than you might think. If you have $2,000 monthly mortgage payments and $300 monthly expenses, then you'd need to charge $3,133 per month in rent to pay these expenses. The market for your property and tenant late payments are all risk factors. These are all factors that can negatively affect your passive income.

The added benefit of renting out rental property is the recurring income. This type of business is particularly popular with people who want to earn extra money while remaining hands-free. The downside is that this type of business involves a lot more risk. Tenants may not pay rent and have poor driving records, which could make them a liability to your business. It is important to consider all the possible risks and devise a plan to address them.

Selling photography online

It is possible to sell your photographs online by setting up your own website. You will have more control over the terms of sale and marketing, and you'll be able to market your work more easily. Fotomoto, Getty Images and Alamy are just a few of the online photo marketplaces. You will need to develop your terms and conditions for use as well customer and user agreements. These are crucial because online photo markets are often the targets of copyright infringement.

It is possible to also sell prints through an online shop. You can sell your images online on many different platforms, with most offering discounts. Online image platforms make it possible to sell your photos for a fraction of the price you would pay in brick-and—mortar shops. This allows you to maximize your profit margins, while also providing an easy service for your customers. Online selling photography is a great passive income idea. It will allow you to increase your income while not having to be hands-on.

FAQ

What do I need to know about finance before I invest?

No, you don't need any special knowledge to make good decisions about your finances.

All you really need is common sense.

That said, here are some basic tips that will help you avoid mistakes when you invest your hard-earned cash.

First, be careful with how much you borrow.

Don't fall into debt simply because you think you could make money.

Make sure you understand the risks associated to certain investments.

These include inflation, taxes, and other fees.

Finally, never let emotions cloud your judgment.

Remember, investing isn't gambling. It takes skill and discipline to succeed at it.

You should be fine as long as these guidelines are followed.

How long does it take to become financially independent?

It all depends on many factors. Some people become financially independent overnight. Others take years to reach that goal. It doesn't matter how long it takes to reach that point, you will always be able to say, "I am financially independent."

It's important to keep working towards this goal until you reach it.

Is it possible to earn passive income without starting a business?

Yes. Most people who have achieved success today were entrepreneurs. Many of them were entrepreneurs before they became celebrities.

However, you don't necessarily need to start a business to earn passive income. You can create services and products that people will find useful.

You might write articles about subjects that interest you. You could also write books. You might also offer consulting services. Your only requirement is to be of value to others.

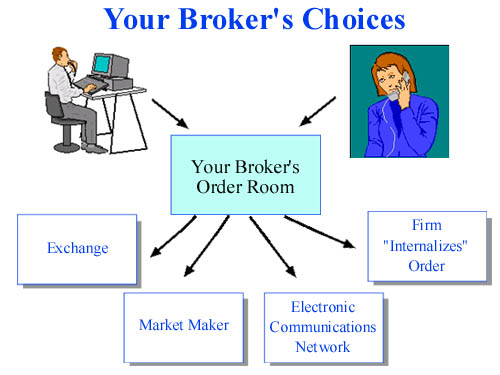

What should I look for when choosing a brokerage firm?

There are two main things you need to look at when choosing a brokerage firm:

-

Fees - How much commission will you pay per trade?

-

Customer Service – Can you expect good customer support if something goes wrong

You want to choose a company with low fees and excellent customer service. Do this and you will not regret it.

Statistics

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

- Over time, the index has returned about 10 percent annually. (bankrate.com)

- 0.25% management fee $0 $500 Free career counseling plus loan discounts with a qualifying deposit Up to 1 year of free management with a qualifying deposit Get a $50 customer bonus when you fund your first taxable Investment Account (nerdwallet.com)

- They charge a small fee for portfolio management, generally around 0.25% of your account balance. (nerdwallet.com)

External Links

How To

How to invest in commodities

Investing is the purchase of physical assets such oil fields, mines and plantations. Then, you sell them at higher prices. This is called commodity trading.

Commodity investment is based on the idea that when there's more demand, the price for a particular asset will rise. The price tends to fall when there is less demand for the product.

You don't want to sell something if the price is going up. You want to sell it when you believe the market will decline.

There are three types of commodities investors: arbitrageurs, hedgers and speculators.

A speculator is someone who buys commodities because he believes that the prices will rise. He doesn't care what happens if the value falls. One example is someone who owns bullion gold. Or an investor in oil futures.

An investor who buys a commodity because he believes the price will fall is a "hedger." Hedging allows you to hedge against any unexpected price changes. If you have shares in a company that produces widgets and the price drops, you may want to hedge your position with shorting (selling) certain shares. You borrow shares from another person, then you replace them with yours. This will allow you to hope that the price drops enough to cover the difference. Shorting shares works best when the stock is already falling.

An "arbitrager" is the third type. Arbitragers trade one thing for another. For example, if you want to purchase coffee beans you have two options: either you can buy directly from farmers or you can buy coffee futures. Futures allow you the flexibility to sell your coffee beans at a set price. The coffee beans are yours to use, but not to actually use them. You can choose to sell the beans later or keep them.

You can buy things right away and save money later. If you know that you'll need to buy something in future, it's better not to wait.

There are risks with all types of investing. One risk is that commodities prices could fall unexpectedly. The second risk is that your investment's value could drop over time. These risks can be reduced by diversifying your portfolio so that you have many types of investments.

Another thing to think about is taxes. When you are planning to sell your investments you should calculate how much tax will be owed on the profits.

Capital gains taxes may be an option if you intend to keep your investments more than a year. Capital gains tax applies only to any profits that you make after holding an investment for longer than 12 months.

If you don't anticipate holding your investments long-term, ordinary income may be available instead of capital gains. For earnings earned each year, ordinary income taxes will apply.

Investing in commodities can lead to a loss of money within the first few years. As your portfolio grows, you can still make some money.